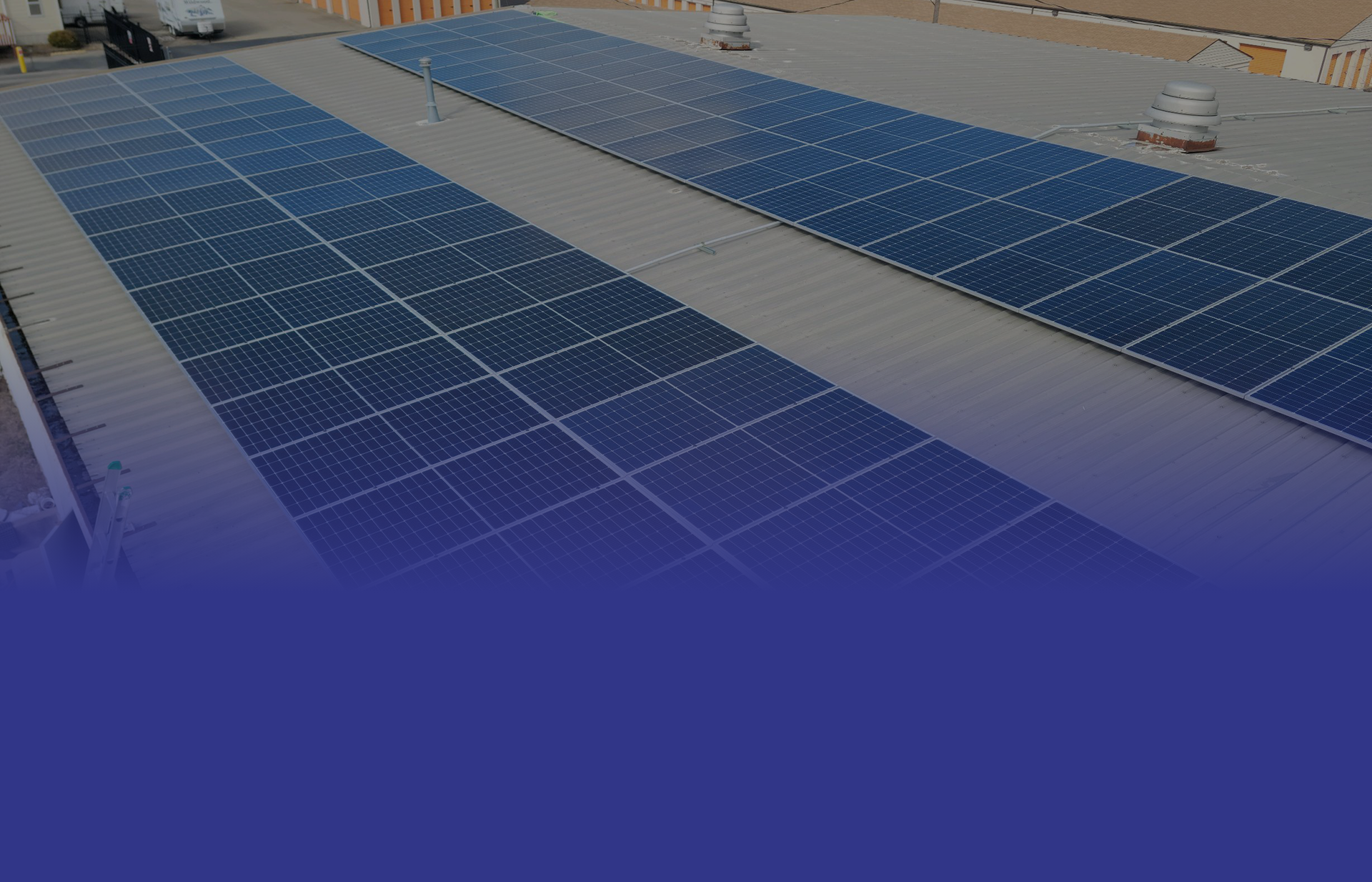

Commercial Solar Solutions

Sustainable Energy for Enhanced Business Efficiency

Transform the way your business consumes energy with Midwest Solar Solutions. Our commercial solar options are designed to offer more than just cost savings — they’re about making a positive impact on your brand, the environment, and your bottom line. Discover how solar energy can become a powerful asset for your business.

Investing in Solar:

A Smart Business Move

In today’s eco-conscious market, going solar is not just an environmental decision, but a strategic business move. Solar energy can significantly reduce operating costs, offer a solid return on investment, and position your company as a leader in sustainability. With our state-of-the-art technology and bespoke solutions, you can harness the sun’s power to fuel your business’s success

Tailored Solar Solutions

for Every Business

At Midwest Solar Solutions, we understand that every business has unique energy needs. That’s why we offer a range of commercial solar solutions, customized to meet your specific requirements and energy goals. Whether you’re a small enterprise or a large corporation, we have the expertise to design and install the most efficient solar system for your business.

Our approach to installing commercial solar systems is centered around minimal disruption and maximal efficiency. We manage every aspect, from initial assessment to installation and maintenance, ensuring a seamless transition to solar energy. Our team of certified professionals works diligently to deliver a high-quality solar solution that aligns with your business objectives.

Schedule Your Business Solar Consultation

Ready to elevate your business with solar energy?